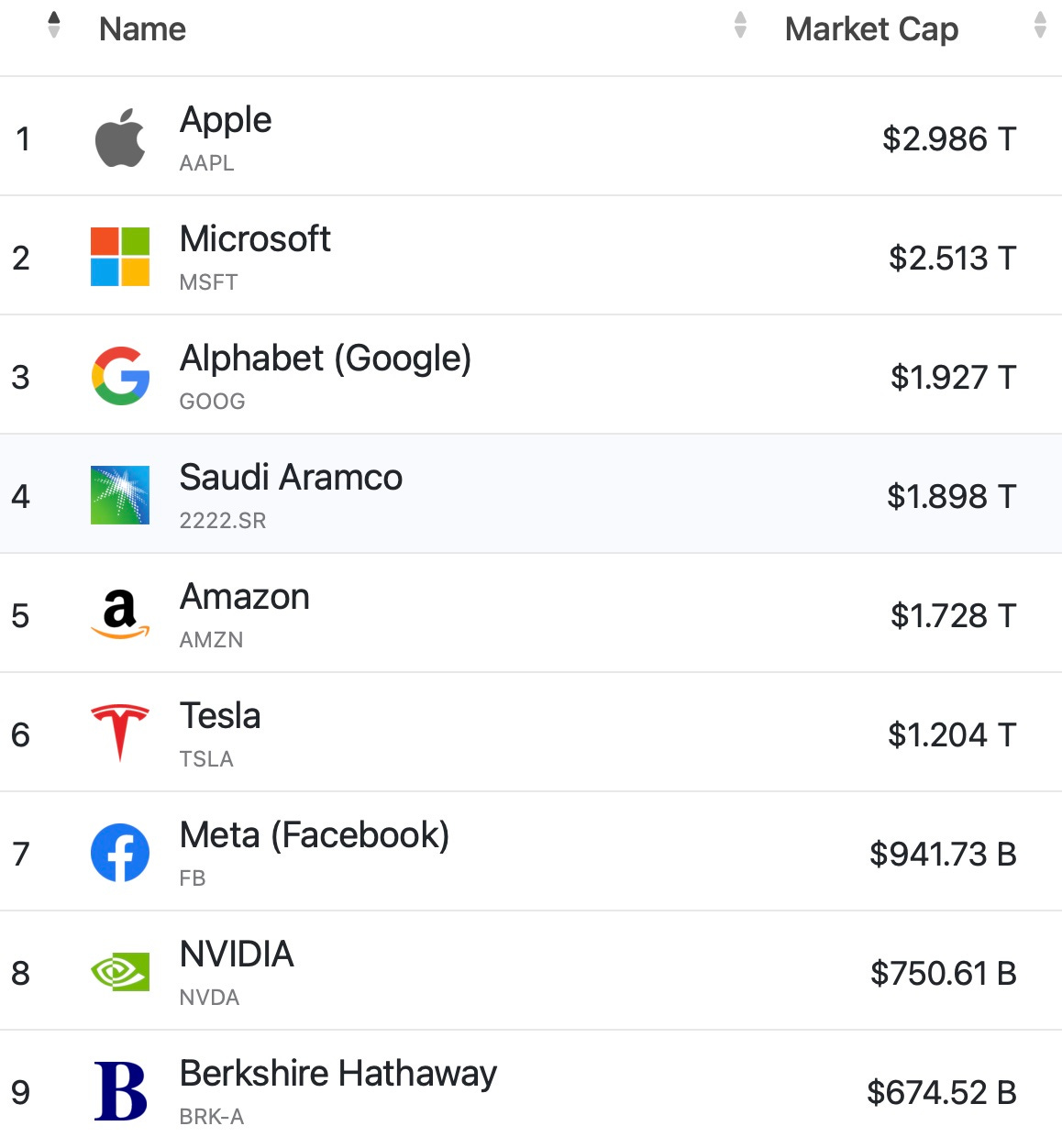

What will the list look like in 5 to 10 years? Here are some streams of thoughts that came to me recently (no financial advice, of course).

1. Apple will continue to do super well by leveraging its unmatched influence at distribution points (devices) and an increasingly integrated, intuitive, and privacy-focused user experience across devices and services. Advertising business models' challenges will continue to fuel Apple's gain in market position. I also expect it to be largely unscathed from the multiyear "regulatory winter" that's likely coming for Big Tech. AR is the "2x wild card" for Apple.

2. Tesla has a decent shot at reaching or surpassing Apple as the most valuable company if it continues to execute like a relentless startup gorging at an endless portfolio of trillion-dollar market opportunities (auto, transportation, energy, insurance, etc) under Elon's zero-bs leadership. In-home AI and automation is a key field where Tesla has a shot at creating an entirely new trillion-dollar market.

3. We might see SpaceX (incl. Starlink, whether we see a spinoff or not) obtain mega-cap or even tera-cap status and make the list within 5 years. Aside from its launch tech with recoverability being far superior to the rest of the industry, the trillion-dollar additional TAM unlocked by a 2, maybe 3, order-of-magnitude cheaper cost-to-orbit and increasing tension and risk of military conflicts between the US and China will propel a new generation of defense companies onto center stage. Palantir might have a shot at making the list for similar reasons, but that's much less certain than SpaceX.

4. We may be close to seeing "peak valuation" for internet giants whose sources of profit are largely dependent on the user info-for-advertising-dollar model. The bi-partisan regulatory headwind based on (legitimate) concerns around privacy and information & expression monopoly is only getting started. On the other hand, crypto and blockchain tech will unleash new forms of information distribution and social platforms with no central intervention/censorship. The resulting decentralization of the distribution of information and expression will begin to weaken Google and Facebook's grip on this ginormous market. Side point: Meta will not be a winner in the metaverse. A key feature of the metaverse will be decentralization and anonymity/privacy. Facebook and Zuck have a reputation of being unable to deliver those things. It will have a part in it, but it will be nothing like the dominance it's had in social media 1.0.

5. Microsoft and Amazon will do relatively well vs other Big Tech ex. Apple, thanks to enterprise and retail being further away from the epicenter of the aforementioned regulatory risks and the disruption from crypto and decentralized information platforms.

Just some raw snippets to hopefully stimulate some thinking and exchanges here.

I approve this message.

Well put! I agree with all of these theses. Perhaps, most of all the mega-caps will perform far less well than the smaller caps like Shopify, Cloudflare etc who are nimble, founder-led and right in the sweet spot for disruptive innovation.